Are Home Improvement Stocks Now Undervalued?

The lockdowns of 2020 may have prompted consumers to put more money toward their surroundings, boosting revenue for home improvement retailers Lowe’s (NYSE:LOW) and Home Depot (NYSE:HD), but the economic and housing availability crunches of 2022 are keeping them there.

Furniture, electronics and home office set-ups aimed at making home a better place to live and work fueled 2020 purchasing, but with consumers facing rising costs of fuel and food, theyre going to home improvement stores to handle repairs themselves and start gardens. This is keeping growth at Lowe’s and Home Depot strong, making them both potentially profitable portfolio additions this summer, in my opinion.

Both options have rising dividend yields, making them attractive for value investors looking to make passive income as well. Before you add either of these home improvement stocks to your portfolio, though, there are some disadvantages to consider.

Lowes

Lowes (NYSE:LOW) is a home improvement retail chain operating in the U.S., Canada and Mexico. It offers products for construction, maintenance, repairs and remodeling. The housing market may be cooling a little from the highs of 2021, which may inspire projects in the home youre in.

Revenues for the company have doubled over the past decade, and earnings per share are expected to grow around 13%. Lowe’s has a dividend yield of 1.66%, and the company has a long track record of rising dividends. That could help sweeten the deal for investors.

Analysts rate Lowe’s a buy, even though bulls think the company faces risks from rising interest rates, supply chain problems and flattening housing prices. Its worth noting that the median age of homes in the U.S. is 39 years, an age when homes will need an increasing amount of maintenance and could be candidates for remodeling.

Lowe’s gets a GF Score of 96, driven primarily by top ratings for profiability and growth.

Home Depot

Surpassing forecasts in nine of the last 10 quarters, another major U.S. home improvement retailer, Home Depot (NYSE:HD), recently reported 10.7% growth in net sales year-over-year.

Home Depot counts professional contractors among its biggest customers, and their big-ticket purchases were up 18% during the past year. EPS has grown 17% over the past three years and revenue is up 8% over the past year, getting it a buy rating from analysts.

Home Depot has a dividend yield of 2.26%, making it the more attractive of these two stocks for those in search of dividends.

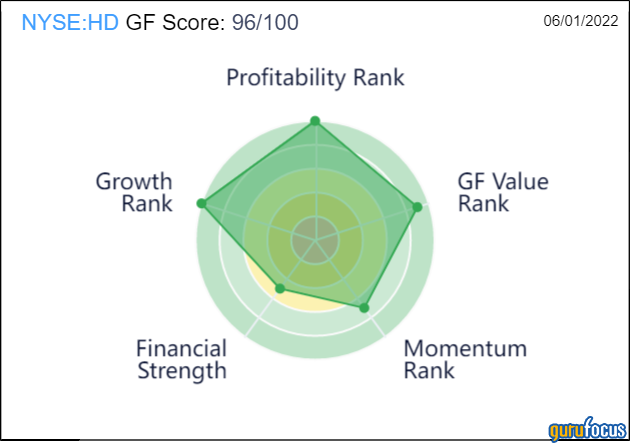

Like Lowe’s, Home Depot also has a GF Score of of 96/100. In addition to high growth and profitability, it scores better than Lowe’s for GF Value, though it loses points for weaker momentum.

This article first appeared on GuruFocus.